How to Prepare Financially for a Baby

Nov 21, 2023 By Susan Kelly

Getting ready for a baby can be an incredibly exciting time for future parents, but as the saying goes, ‘it takes money to make babies.’ Being aware of and prepared for the financial side of having a child can help relieve some stress from this life-changing event.

Luckily, many options are available to new parents to organize their finances before the baby arrives. This blog post will discuss the necessary steps to properly prepare financially when expecting a little one!

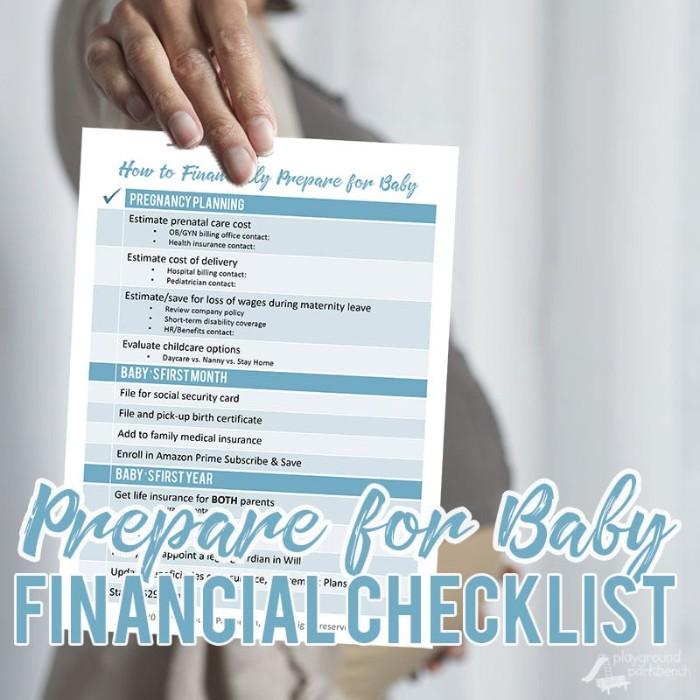

How to Financially Prepare For a Baby

Following are the key steps parents should consider ensuring their finances are in order before a baby arrives:

Start a Savings Plan

Consider setting up a separate savings account for baby-related expenses. This will help you keep track of your finances and ensure you have the money available when it’s time to buy items like car seats, cribs, or even diapers.

Start Budgeting

Now is a great time to start budgeting and tracking your expenses. Knowing where your money is going now will help you estimate the potential costs of having a baby and allow you to adjust spending accordingly.

Investigate Childcare Costs

Whether you plan on hiring a nanny or enrolling your child in daycare, start researching the average rates for childcare in your area so that you can include it in your budget.

Get Life Insurance

Purchasing a life insurance policy will ensure that your family is taken care of financially in the event of an unexpected death. This makes peace of mind and provides your loved ones economic security.

Review Your Benefits

Many employers offer additional benefits to employees expecting or having just had a baby. Look into the benefits offered by your employer, such as maternity leave pay or childcare reimbursement programs.

Consult a Financial Professional

If you’re feeling overwhelmed by the different financial steps to take in preparation for a baby, consider talking to a financial professional who can provide personalized advice on how to best manage your finances before and after the baby arrives.

They can help you create a detailed budget, set up savings plans, and advise on other financial considerations that come with welcoming a new addition to your family.

Having an experienced professional backing you up will give you the confidence to make smart choices for you and your little one.

Consider Flexible Spending Accounts and Tax Credits

Flexible spending accounts (FSAs) are employer-issued pre-tax accounts that can be used to pay for certain medical expenses, like co-pays and deductibles. This can help you save money on taxes while still allowing you to pay for the costs of having a baby.

Likewise, some of your expenses associated with having a baby may qualify for tax credits when filing taxes. It’s important to research the available tax credits and deductions to determine what you qualify for and how to best take advantage of them.

Preparing financially for a baby can help ensure your family is secure and reduce any unnecessary financial stress. Setting up savings accounts and researching tax credits ensures you’re financially ready for your little one’s arrival.

Research Health Insurance Options

Remember to look into options for covering your newborn once they arrive, as some health insurance plans may not cover them immediately.

Reviewing the different coverage levels and what each plan covers is also important. This will help you make an informed decision about which one is best for you and your family.

By taking the time to properly prepare financially for a baby, you’ll be setting your family up for success. From budgeting to researching insurance plans and tax credits, there are many ways you can ensure that you’re ready for your little one’s arrival.

Review the Current Debt Situation

Having a baby is an exciting but expensive time. If you carry any debt, such as student loans or credit card debt, it’s important to take stock of your financial situation and review what you owe. Prioritize paying off the debts with higher interest rates first so that the amount you have to pay back is lower. This will free up more cash flow to be allocated to other needs, such as the costs of having a baby.

You may also want to investigate debt consolidation options or talk with a credit counselor who can help you develop a repayment plan that works best for your situation.

By taking action on your debt now, you can focus on the more exciting aspects of preparing for your little one’s arrival.

Overall, there are many ways you can prepare financially for a baby. From reviewing your benefits to researching tax credits and FSA accounts, it’s important to do your due diligence and ensure that your financial needs are handled before your new bundle of joy arrives. With some planning and research, you can ensure you’re financially prepared for parenthood.

Create A Will

A will ensures that your assets and property are distributed according to your wishes, so you can rest assured that everything is handled if the worst happens.

Lastly, don’t forget to name a guardian for any children in the event of their parent's death. This can be a difficult conversation, but it’s essential for your child's safety.

By preparing financially for a baby, you can give your family peace of mind knowing their future is secure. Having a plan in place now will ensure that your little one has all the financial resources they need as they grow and develop into adulthood.

Working with a financial advisor or tax professional can be extremely helpful in navigating the complexities of financial planning for a baby. They can help you find additional ways to save money and ensure you take advantage of all the available benefits and tax credits.

FAQs

How much does it cost to have a baby?

The cost of having a baby varies widely depending on your circumstances. Generally speaking, the average first-year costs for everything from diapers to childcare can range from $5,000 to over $15,000. It's important to factor in all the upfront and ongoing expenses of raising a child when planning your budget.

What are some ways to save money when preparing for a baby?

There are several ways to help cut costs when preparing for a baby. Start by creating a budget and tracking your expenses to ensure you stay on track. Consider ways to save money on items such as clothing, diapers, childcare, and more.

You may also be able to find savings through discounts or coupons, utilizing hand-me-downs from family or friends, and asking for baby supplies or services as gifts. Additionally, look into government assistance programs that may be available to you.

What should I do financially before having a baby?

Before having a baby, it's important to understand your finances to create a budget and prepare for additional expenses. Start by creating a budget to identify your income and expenses, then look for ways to cut back or save money where possible.

You can also build an emergency fund with at least three months of living expenses and start a college savings account if you have more than one child. Finally, make sure that you have the necessary documents in order, such as wills and trusts.

Conclusion

All in all, preparing for a baby is an exciting experience of joy and anticipation. That being said, it is important to remember that additional costs are associated with becoming a parent. Recognizing this fact prepares you to take on the financial side of growing your family. Being organized and having a plan before the baby arrives will help reduce unnecessary stress or worry during this life-altering moment.

From setting aside money for medical bills to creating a budget for baby items, expecting parents can ensure their child’s financial well-being from day one. Focusing on these tips and advice before babies' arrival will give future parents peace of mind when it comes time to begin this incredible journey! So, set yourself up by taking the first steps toward How to Prepare Financially for a Baby today!